december child tax credit payment amount

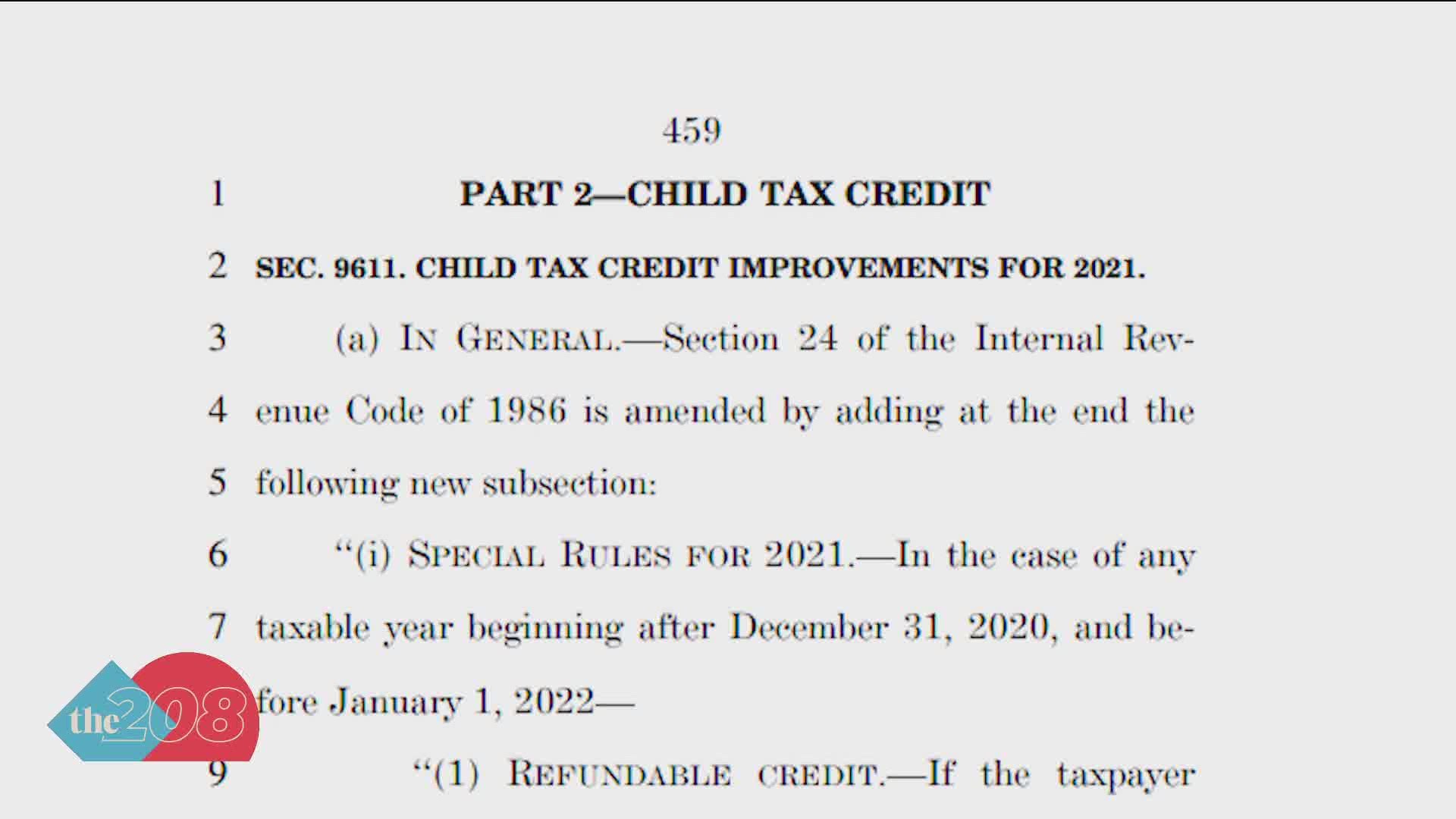

It also established monthly payments which began in July. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

S part of the American Rescue Plan families received a Child Tax Credit with the first payments being made in July 2021 and the last one made on December 15 that same.

. The maximum CTC payment currently. Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment. If you received your first payment in December you got up to 1800 for each child age 5 and under and 1500 for each kid age 6 to 17.

That 2000 tax credit is available to single taxpayers earning less than 200000 and married couples earning less than 400000 although the tax credit starts to phase out for. 3000 per child 6-17 years old. Since July the Child Tax Credit previously a once-a-year credit has been sent out in the form of a direct payment worth up to 300 per month for eligible families.

Families who will be claiming payments for the first time will be getting 1800 per child under age six this month. Are Child Tax Credit Payments Taxable. The deadline to do so is 15 November.

The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. The Child Tax Credit provides money to support American families. For many families the credit then plateaus at 2000 per child and starts to phase out for single parents earning more than 200000 or for married couples with incomes above.

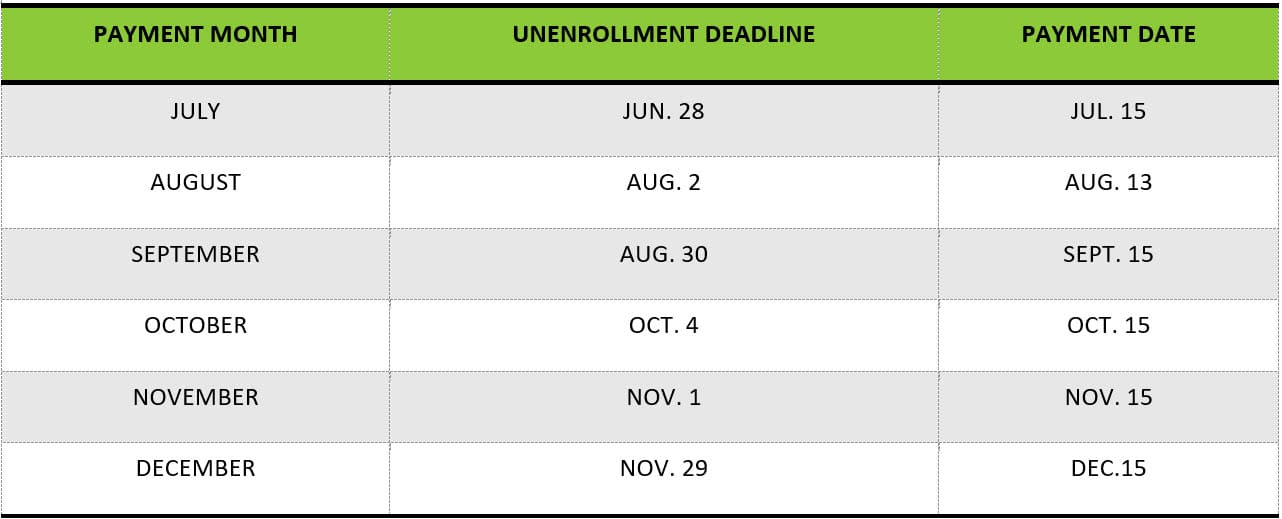

Here is some important information to understand about this years Child Tax Credit. On December 15 remittances of 300 or 250 will be sent normally by the Internal Revenue Service IRS. What changes in December with the child tax credit payments.

Already claiming Child Tax Credit. As with previous checks eligible families with children under age 6 will receive 300 per child while those with children. The advance monthly payments amount to up to 300 for each child age 5 or younger and up to 250 for those ages 6 to 17.

Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in your. The maximum Child Tax Credit increased to 3600 for children under the age of 6 and to 3000 per child for children between ages 6 and 17. However families that are already receiving the maximum payment on the child tax credit scheme will not receive an increased payment.

Up to 1800 per child. Some families who qualify received up to 900. The credit for qualifying children is fully.

Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. In this instance families have to use the IRS dedicated Get CTC Online Tool to provide their details and trigger the monthly payments. 3600 per child under 6 years old.

The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and 500 for college students aged up to 24. The amount you can get depends on how many children youve got and whether youre. For each child aged six to 17 families will.

All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single. How much will I receive in the December CTC payment. It also provided monthly payments from July of 2021 to.

It means those not receiving the payments for the first five months but who chose and qualified for the December payment may get the full first half of the credit from December. Making a new claim for Child Tax Credit. The credit was increased to 3000 from 2000 with a 600 bonus for kids under the age of 6 for the 2021 tax year.

Child Tax Credit Payments For American Families End December 15 Bloomberg

Harder To Pay The Bills Now That Child Tax Credit Payments Have Ended

Child Tax Credit Payments May Be Smaller For Some Going Forward Wfaa Com

Child Tax Credit Payment Schedule For 2021 Kiplinger

New Child Tax Credit Explained When Will Monthly Payments Start Ktvb Com

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

How Much Money Will Families Have Received From Child Tax Credit By December 2021 As Usa

Child Tax Credit Updates Why Will December Payments Be Bigger Than The Others Marca

Final Check Child Tax Credit Payment For December Youtube

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit Payments To Begin July 15 Sciarabba Walker Co Llp

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

Child Tax Credit December Will This Week S Payment Be The Last One Marca

Child Tax Credit Advanced Payments Information Bc T

Millions Of Families Will Receive A Child Tax Credit Monthly Payment Next Week It Could Be The Last One Cbs News

Most Americans Plan To Put Advanced Child Tax Credit Into Savings

Krs And Associates You May Have Questions About The Upcoming Changes To The Child Tax Credit The Credit Amounts Have Been Expanded And Payments Will Start In July And Go Through

December Child Tax Credit What To Do If It Doesn T Show Up 11alive Com

Enhancing Child Tax Credits Support Of New Jersey S Neediest Families New Jersey State Policy Lab